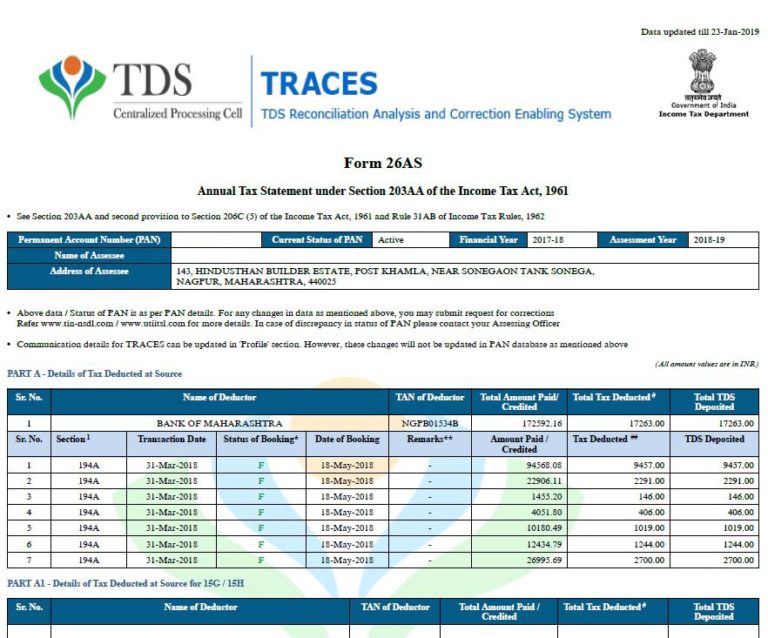

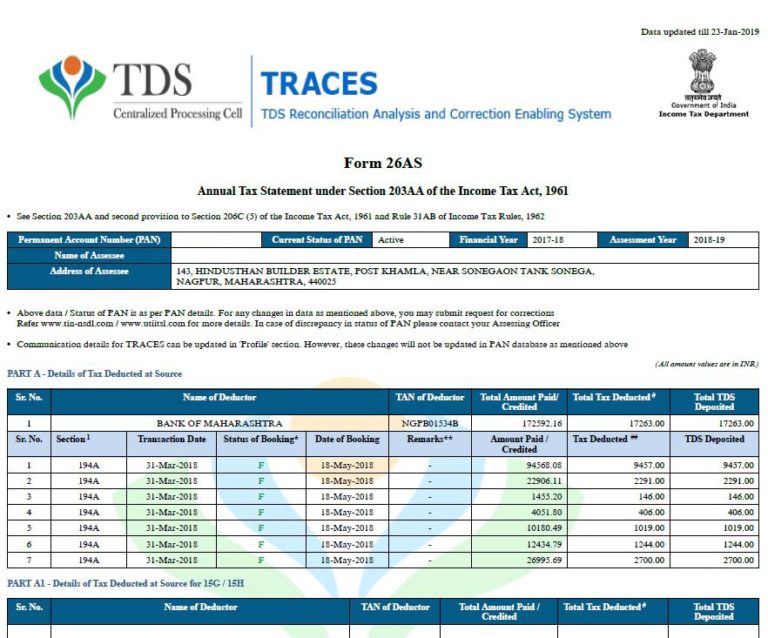

Part A: Details of Tax deducted at source:. Various parts and details of Form 26AS statement:įorm 26AS is divided in 9 parts which are as follows: Once you click the view button view button “export as PDF” button will get enabled where we can download the 26AS statement in PDF format. Now, you will able to see the TDS and other details. Now select the Assessment Year for which from the drop down and from view as drop down select “HTML” option and click on “view/ download” button (which will get enabled once you select the above two option).

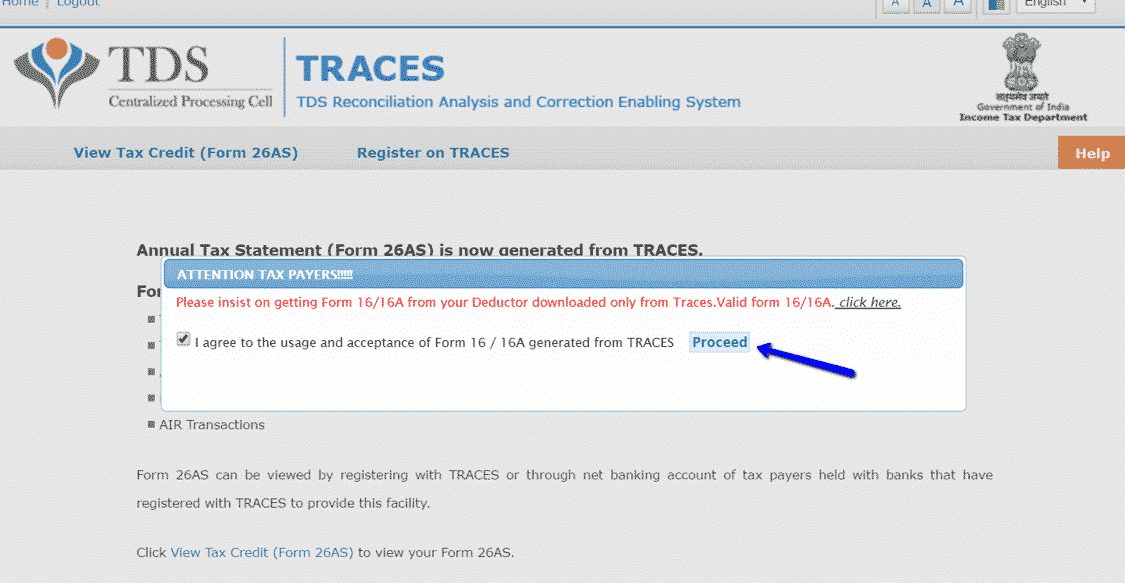

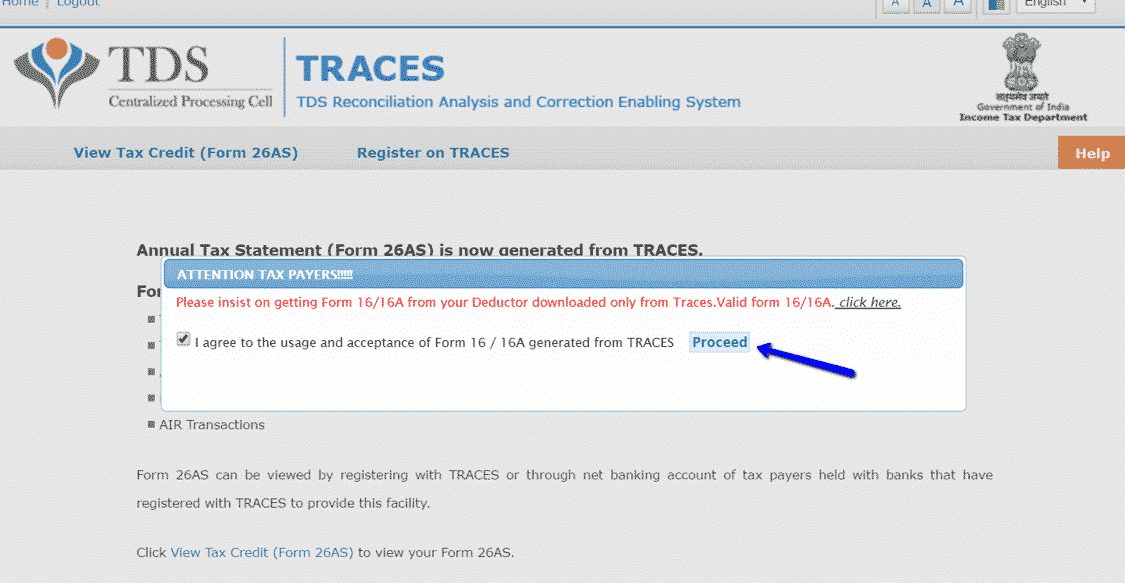

All evidence-based statements are supported with proper reference to Section, Circular No., Notification No.Subscribe to Whats App Updates Enter your email address:. Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied. The golden rules of grammar, style and consistency are thoroughly followed. All evidence-based statements are supported with proper reference to Section, Circular No., Notification No.  Every content published by Taxmann is complete, accurate and lucid. Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications. All the latest developments in the judicial and legislative fields are covered. The statutory material is obtained only from the authorized and reliable sources. The team ensures that the following publication guidelines are thoroughly followed while developing the content: The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. Taxmann Publications has a dedicated in-house Research & Editorial Team. If you want to download Form 26AS in PDF, click on Export as PDF and save the Form 26 AS for future use. Select the relevant assessment year for which Form 26AS is required and Select ‘View Type’ (HTML or Text). Click on the ‘View Tax Credit (Form 26AS)’ option. At the TDS-CPC website, agree to the acceptance and usages of Form 16 / 16A generated from TRACES and click on ‘Proceed’. After confirming, you will be redirected to the TDS-CPC website. Read the disclaimer and click on the ‘Confirm’ button.

Every content published by Taxmann is complete, accurate and lucid. Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications. All the latest developments in the judicial and legislative fields are covered. The statutory material is obtained only from the authorized and reliable sources. The team ensures that the following publication guidelines are thoroughly followed while developing the content: The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. Taxmann Publications has a dedicated in-house Research & Editorial Team. If you want to download Form 26AS in PDF, click on Export as PDF and save the Form 26 AS for future use. Select the relevant assessment year for which Form 26AS is required and Select ‘View Type’ (HTML or Text). Click on the ‘View Tax Credit (Form 26AS)’ option. At the TDS-CPC website, agree to the acceptance and usages of Form 16 / 16A generated from TRACES and click on ‘Proceed’. After confirming, you will be redirected to the TDS-CPC website. Read the disclaimer and click on the ‘Confirm’ button.

Go to the ‘e-file’ menu> click on Income tax returns> Select ‘View Form 26AS ‘.Click on Login on the top right of the home page.Start your search on any concept of the Law using keywords or section no.ġ0,000+ Free Trials already taken in the last week ! Start yours Now !įor downloading Form 26AS, a taxpayer needs to follow the following steps: Introducing | Practice – Always Updated Income-tax Law on your Fingertips!

0 kommentar(er)

0 kommentar(er)